When a loved one dies, someone needs to go through and cancel or change the name on their various accounts. If you’re reading this article, chances are this duty has fallen to you.

Here is our best and most helpful list of accounts to cancel when a loved one dies. These are subscriptions or memberships that are commonly held by most people in the USA. Additionally, at the end you will find handy ideas on how to figure out what accounts are held by the decedent.

Our website is supported by our users. We sometimes earn a commission when you click through the affiliate links on our website. See our privacy policy & disclosures for more information.

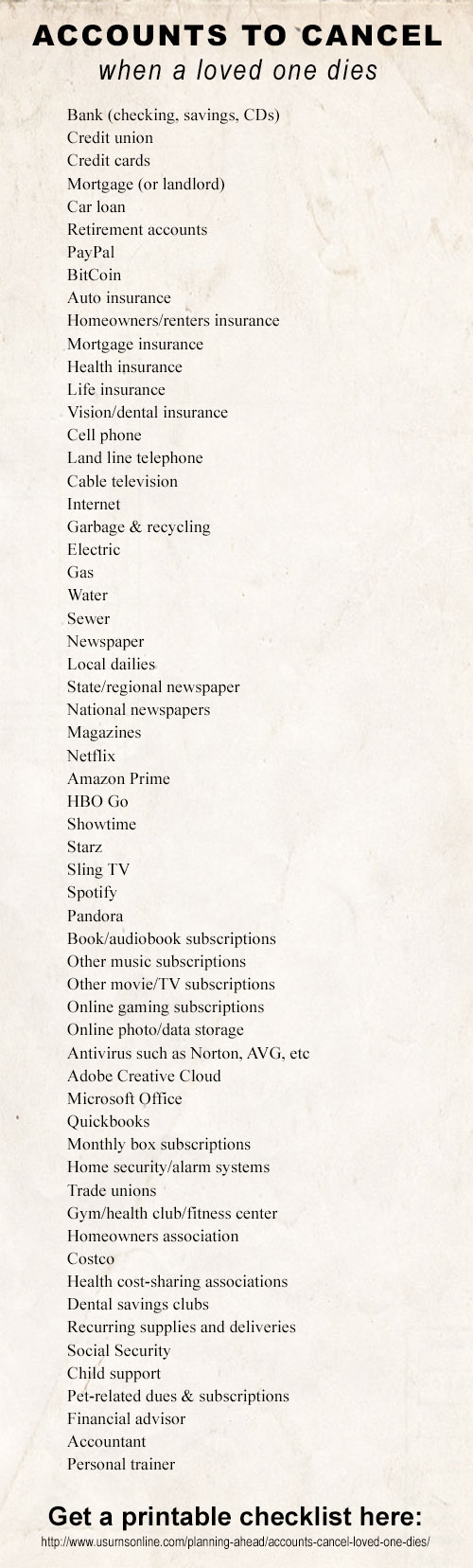

List of Accounts to Cancel When a Loved One Dies

Some of these items will need to be canceled. Others, depending on your situation, will need to have an ownership transfer. Note that many people have banking, credit card, CD, car payments, and/or retirement accounts with more than one institution.

FINANCIAL ACCOUNTS

- Bank (checking, savings, CDs)

- Credit union

- Credit cards

- Mortgage (or landlord)

- Car loan

- Retirement accounts

- PayPal

- BitCoin

INSURANCE

- Auto insurance

- Homeowners/renters insurance

- Mortgage insurance

- Health insurance

- Life insurance

- Vision/dental insurance

UTILITIES

- Cell phone

- Land line telephone

- Cable television

- Internet

- Garbage & recycling

- Electric

- Gas

- Water

- Sewer

SUBSCRIPTIONS

Many of these will continue charging as long as the credit/debit card is valid. You can sometimes get partial or full refunds for many of these subscriptions; simply call and ask.

- Newspaper

- Local dailies

- State/regional newspaper

- National newspapers

- Magazines

- Netflix

- Disney+

- Amazon Prime

- Book/audiobook subscriptions

- Music subscriptions

- Movie/TV subscriptions apart from cable such as HBO Go and Hulu

- Online gaming subscriptions

- Online photo/data storage

- Software

- Antivirus such as Norton, AVG, etc

- Utilities such as Adobe, Microsoft Office, Quickbooks, etc

- Monthly box subscriptions

- Clothing boxes

- Meal packages

- Shaving club

- Home security/alarm systems

MEMBERSHIPS

- Trade unions

- Gym/health club/fitness center

- Homeowners association

- Costco

- Health cost-sharing associations

- Dental savings clubs

BUSINESS OWNERS

- Business bank accounts

- Business credit cards

- Business phone/internet

- Business utilities

- Business insurance

- Business car insurance

- Business memberships

- Website – Hosting, domain name, SSL, content management systems, other services

- Local business associations, Better Business Bureau, etc

- Advertising – Online, print, billboards, etc

- Recurring supplies and deliveries

- Certifications

OTHER ACCOUNTS AND DUES

- Social Security

- Voter registration

- Child support

- Pet-related dues & subscriptions

- Financial advisor

- Accountant

- Personal trainer

Printable List

We’ve prepared this list in an easy-to-use printable form, complete with checkboxes, space for notes, and plenty of room for additional accounts or memberships.

You can print or save the PDF list here:

How to Find Accounts to Cancel

Now that you’ve browsed through the big list of accounts to cancel when a loved one dies, how do you figure out which ones they had? Here are some tips.

1. GET A COPY OF THE DEATH CERTIFICATE

Get multiple copies of the death certificate (most sources say 10-20). Financial institutions and insurance companies will require a copy before you can close, switch, or cancel accounts. You will certainly need a copy before you get any life or burial insurance payouts.

Also, be sure to scan a copy into your computer so you have a digital version. This way you can easily send it in an email for faster service in some instances, or you can print more (unofficial) copies. This will make everything easier if you find that, six months down the road, you get a massive bill from an overdue DVD rental or an unreturned power tool rental.

Lastly, some states or other institutions require a “letter of administration” or “testamentary,” which is something that proves that you have the authority to act on your loved one’s behalf. You can obtain this from your attorney if needed.

2. MAKE A LIST & TAKE NOTES

Use our printable list of accounts to start your own list. Check off each one as it is canceled, but be sure to note the date you called or wrote and who you spoke with, and any confirmation numbers if supplied. This is a simple, 2-minute task that may save you a lot of headache later on.

3. FIND THEIR PASSWORDS

Many of the smaller dues and subscriptions can be accessed by an online account; if you have access to the decedent’s username and password you can close or cancel many of these accounts without a lot of the official rigamarole.

4. WATCH THEIR BANK AND CREDIT CARD ACCOUNTS

This is an easy way to find those little media subscriptions that will nickel and dime the estate. Go back through the past year’s checking and credit card statements, and anything that looks like a subscription, call and make sure it is canceled and ask for a refund.

Next, scan their statements for hints of other accounts. It could be you find a single $100 transfer to Ameritrade that leads you to a nice chunk of change squirreled away in an IRA acocunt. Or perhaps you find an autopay that leads you to a rewards credit card you didn’t know they opened.

5. WATCH THE MAIL

You’ll see statements, bills, magazines, and packages arrive in the mail. Add each one to your list of accounts or memberships to cancel. Subscriptions exist for just about everythings these days, from clothes and shoes to household supplies like air and water filters.

Help Improve This List

If you find additional accounts or memberships to add to this list, help us improve it by commenting below. The goal is to help those who have lost a loved one be able to remember and access the accounts they need to cancel quickly and easily, and at the lowest cost.

Read next: What papers do you need when someone dies?

Daniel has been working in the funeral industry since 2010, speaking directly to grieving families as they made funeral arrangements.

He began researching and publishing funeral articles on this website as part of his role as product and marketing manager at Urns Northwest.

Having written hundreds of articles and growing the site to multiple millions of views per year, Daniel continues to write while providing editorial oversight for US Urns Online’s content team.

You do not know what you are talking about. The executor does these things and should confer with the attorney before doing anything.

Hi Gail,

Yes, exactly! The executor does these things and should definitely confer with the attorney. Still, often the executor has never done anything like this, plus people keep looking for answers on this topic, which is why we wrote the article. We hope it is helpful to them!

At some point along the way I guess you unexpectedly become the person who is handling affairs like this for the first time in your life. Thank you so much!

Thank you so much for this article and list. I am currently gathering information for my executor and I found this very helpful.

I am the daughter of a Healthy, Vibrant, young 92 yr old. I am 63 and have no experience at all when It comes to what I need to do when Dad passes. I thank you very much for this list. It gives me a starting point. Very thoughtful of you! I cannot thank you enough!

Almost everyone needs a list like this. I have asked my executor to hire the woman who works for me to do these things. She is the only one that will know about my accounts, both online and off. Thanks for sending this it should be very helpful.

I don’t see anything about canceling their social media accounts. I understand canceling a Facebook account is nearly impossible. I have 3 friends who have passed whose Facebook accounts are still active.

Great point! Most social media accounts don’t get “cancelled” but rather are “memorialized,” meaning they still exist as a memorial to the things they’ve said and done. But yes, many people want to do something about the person’s social media accounts, so that you for your comment!

Add Lawn/Pest Service.

A few others for the list:

– driver’s license

– voter’s registration

– also notify credit bureau

I don’t know about other states but in Texas, child support is not canceled. It is still paid from the estate.

Excellent post. I’m going through some of these issues as well..

Not everyone leaves a will as was the case with my parents. Between the 3 of us siblings we took care of everything. No attorney required in CA. But if you have never had to go through a death ( I’ve lost 5) this list helps to have everything in order for those that are left behind. I will be leaving this list and others for my son to make it as easy for him when my time comes. I’ve already taken care of the burial plot and funeral arrangements

Nadine

This is an excellent article! I have been making lists and lists of everything that needs to be done. This list wraps up everything all together in one article. I would also want to mention how important it is to have all passwords used for anything be written down in a Password Book to help those taking care of your Estate easy access to cancel. I bought a book of Amazon it’s perfect!

Wine clubs

Earthquake insurance

Library cards

PayPal

Airline rewards programs

Hotel rewards programs

Time Share

Final tax returns

CSA subscription (vegetables etc.).

Grocery or other online “set & save” type standing orders for regular delivery.

Professional liability insurance (my have this even if not a business owner).

Health alert systems (you will probably have to return equipment first).

Some insurance shouldn’t be canceled until no longer needed (home, umbrella, etc).

Make sure to call the credit score companies like Equifax, Transunion, so no one can steal the identity

Thank you. I made a filled in copy for the person in charge to use if I become incapacitated or die. It’s not only the Executor or the one with the power of attorney that needs to know these things.

In this day and age where our society has allowed online only account access finding account passwords will be difficult. If the person is safety savvy they change their passwords frequently and a list is of no use. If you can find their computer password and you have their laptop you may find most of all their accounts with up to date passwords. Under settings you may find a password storage section. This could be a gold mine to find obscure or current accounts.

Why is it that no one ever thinks to cancel their loved ones voter registration? Seriously, do you want your parents voting from the grave for the wrong candidate?

Cindy